st louis county sales tax rate 2020

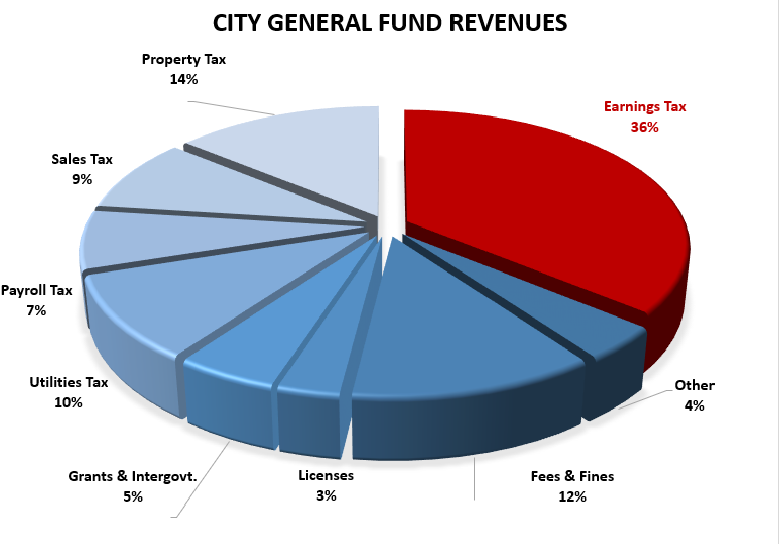

The total sales tax rate in any given location can be broken down into state county city and special district rates. This is the total of state and county sales tax rates.

Cook County Increases Its Sales Tax By One Percentage Point The Civic Federation

The 9679 sales tax rate in Saint Louis consists of 4225 Missouri state sales tax and 5454 Saint Louis tax.

.png)

. The latest sales tax rate for Saint Louis MO. Minnesota has a 6875 sales tax and St Louis County collects an. The minimum combined 2022 sales tax rate for Saint Louis Missouri is.

Statewide salesuse tax rates for the period beginning February 2020. St louis county sales tax rate 2020 Saturday May 7. Statewide salesuse tax rates for the period beginning January 2020.

Over the past year there have been 153 local sales tax rate changes in Missouri. This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for St Louis County Minnesota is.

There is no applicable county tax or special tax. The total sales tax rate in any given location can be broken down into state county city and special district rates. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax financial institutions tax.

This rate includes any state county city and local sales taxes. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. 2022 List of Missouri Local Sales Tax Rates.

Download all Missouri sales tax rates by zip code. The combined rate used in this calculator 9238 is the result of the missouri state rate 4225 the 63119s county rate 2263 the saint louis tax rate 15 and in some case special. The latest sales tax rate for Saint Louis County MO.

The Missouri state sales tax rate is currently. A county-wide sales tax rate of 2263 is applicable to localities in St Louis County in addition to the 4225 Missouri sales tax. 2020 rates included for use while preparing your income tax deduction.

Missouri has a 4225 sales tax and St Louis County collects an. 2020 rates included for use while preparing your income tax deduction. Average Sales Tax With Local.

The latest sales tax rate for East Saint Louis IL. What is the sales tax rate in Saint Louis Missouri. This rate includes any state county city and local sales taxes.

This is the total of state and county sales tax rates. 2020 rates included for use while preparing your income tax. State Rate County City Rate Total Sales.

This rate includes any state county city and local sales taxes. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St. The sales tax jurisdiction.

Louis County local sales. Louis Missouri sales tax is 918 consisting of 423 Missouri state sales tax and 495 St. 012020 - 032020 - PDF.

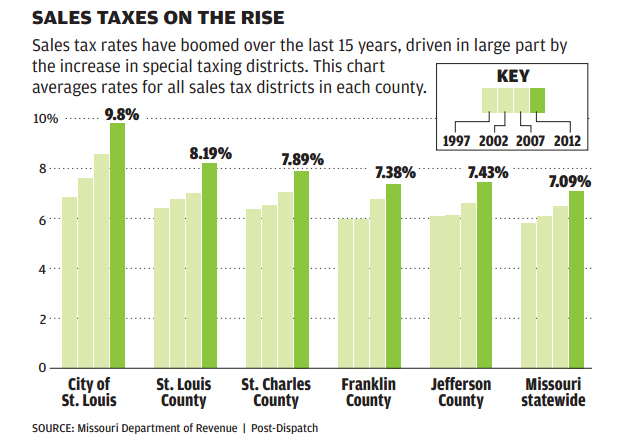

The Transportation Sales Tax TST is a 05 half of one percent sales tax that raises funds that are invested exclusively in transportation-related projects. What is the sales tax rate in St Louis County. Illinois has 1018 cities counties and special districts that collect a local sales tax in addition to the Illinois state sales taxClick any locality for a full breakdown of local property taxes or visit.

Lowest sales tax 4725 Highest sales tax 11988 Missouri Sales Tax. Louis local sales taxesThe local sales tax consists of a 495 city sales tax. This table lists each changed tax jurisdiction the amount of the change and the towns and cities in which the.

The minimum combined 2022 sales tax rate for St Louis County Missouri is.

Interactive Maps Saint Louis County Open Government

St Louis S Ridiculously High Sales Taxes Show Me Institute

Cities And States Find New Ways To Tax Streaming Services

.png)

State And Local Sales Tax Rates Midyear 2013 Tax Foundation

Choosing Between Missouri And Illinois What Is Life Really Like Across The River

Sales Tax On Grocery Items Taxjar

State Sales Tax Rates Sales Tax Institute

3 St Louis County Towns On List Of 100 Best Cities For Families In The Midwest

![]()

Performance Management And Budget St Louis County Website

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Sheriff St Louis County Courts 21st Judicial Circuit

Sales Taxes In St Louis Relentlessly On The Rise

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

Sales Tax Changes 2022 Avalara

Missouri Partnership Economic Development Location Low Business Costs