salt tax cap removal

House Democrats who are pushing to lift a 10000 fixed cap on state and local tax SALT deductions said they will support the Inflation Reduction Act which passed the. By Joey Fox October 20 2021 252 pm.

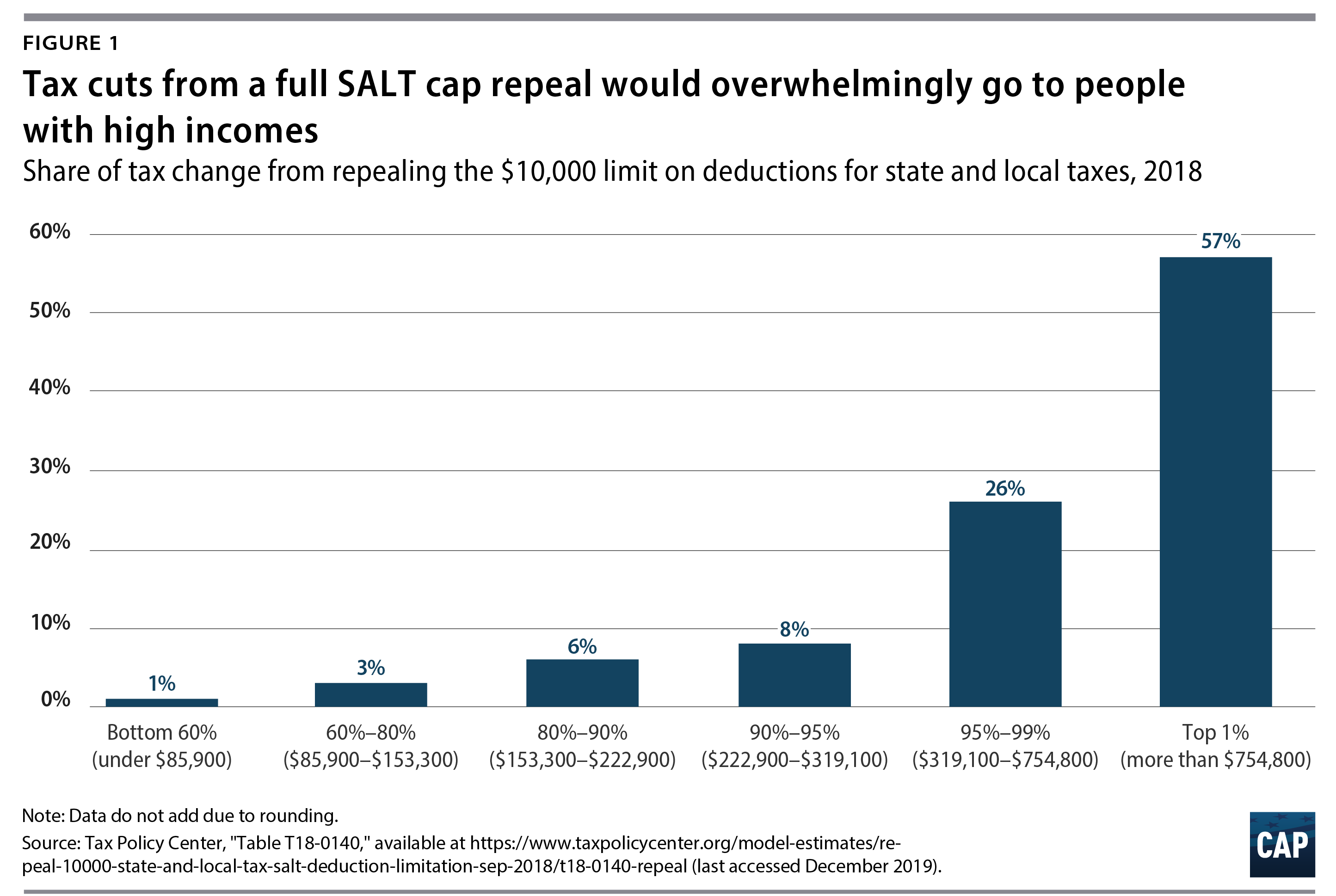

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

The deal which was included.

. The SALT deal appeared to remove one obstacle to passing the sprawling. The SALT deduction benefits only a shrinking minority of taxpayers. Responding to reports from yesterday that the State and Local.

Republicans on the fence like Reed were crucial to passing the 2017 tax bill which passed 227-203. October 4 2021. In urging repeal of the 10000 cap on the deduction for state and local taxes SALT Rep.

Tremont Library Job Fair October 26 2022. The so-called SALT deduction was capped at 10000 by former President Donald Trumps tax reform bill which became law in late 2017. Murphy pushing for SALT cap removal isnt willing to make an ultimatum.

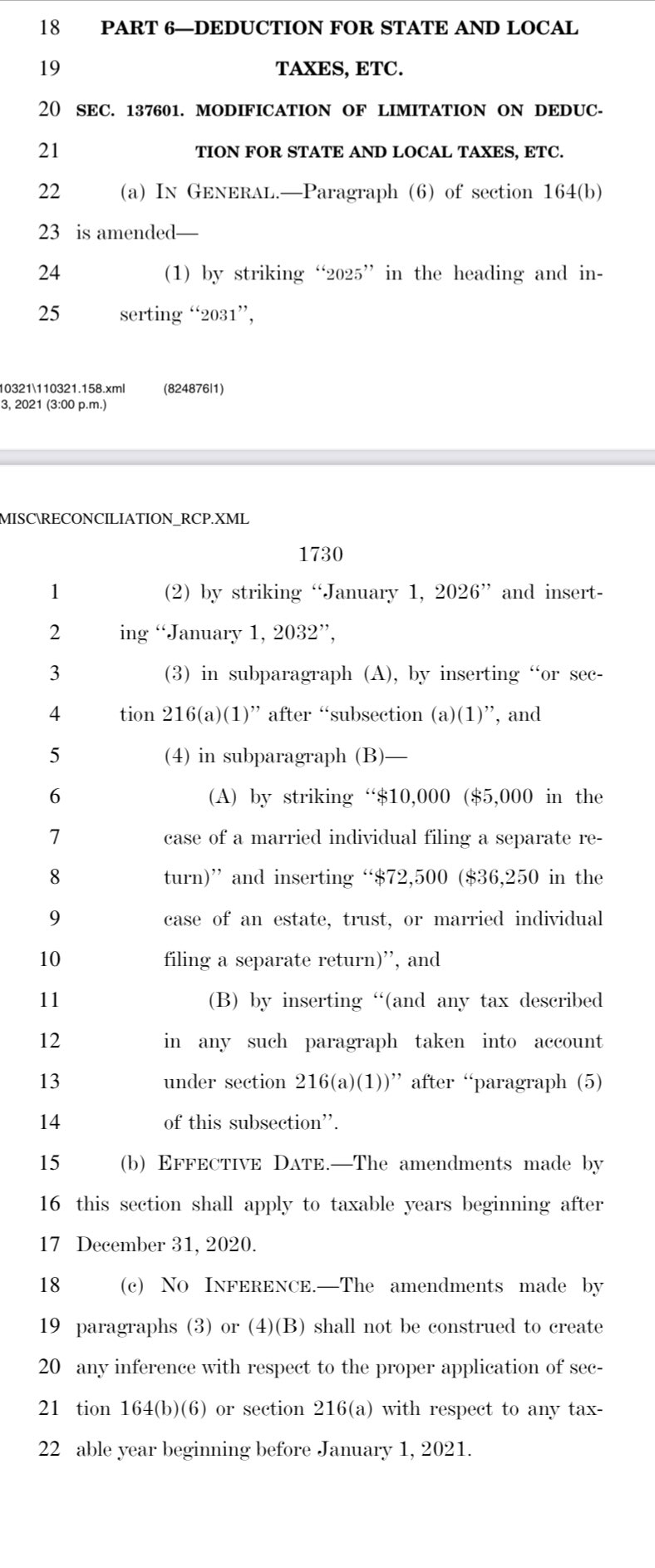

Second the 2017 law capped the SALT deduction at 10000 5000 if youre married and file separately from your spouse. WASHINGTON DC Today Congressman Mondaire Jones D-NY hosted a press conference to announce the SALT Deductibility Act which would remove Donald Trumps. The relaxed cap an increase from the current 10000 limit would last for a decade until 2031.

The governors on Friday argued For the first time since Abraham Lincoln created the federal income tax the cap on SALT deductions established a system of double taxation. A group of powerful Democratic governors is pressuring President Joe Biden to lift a cap on state and local tax deductions known as SALT. Taxpayers particularly wealthy people.

This means you can deduct no more than. Eleven Republicans from high tax states voted against it largely due to the. Democrats have forged a compromise to partially lift the so-called SALT tax deduction cap that.

Barnum Financial Groups Free Educational Webinar October 25 2022. As policymakers weigh whether to lift or repeal the 10000 cap on state and local tax SALT deductions enacted by the Tax Cuts and Jobs. Salt Snow Removal Equipment Snow Melting.

Using LinkedIn to Jumpstart Your Career October 26 2022.

Salt Deduction That Benefits The Rich Divides Democrats The New York Times

Dems Don T Repeal The Salt Cap Do This Instead Itep

New York State Budget Provides A Work Around To The Federal Salt Cap For Certain Business Entities

Suozzi Pushes For Salt Cap Repeal In Infrastructure Plan

Black Hispanic Families Would Benefit Less From Salt Cap Repeal

Why A 10 000 Tax Deduction Could Hold Up Trillions In Stimulus Funds The New York Times

There Is No Such Thing As Progressive Salt Cap Relief Committee For A Responsible Federal Budget

Salt Deduction Limits Aren T So Bad For The Middle Class Bloomberg

Igor Bobic On Twitter According To A Summary Of The Budget Resolution The Finance Committee Is Being Instructed To Include Salt Cap Relief In The Reconciliation Bill Twitter

/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

Salt Cap Democrats Still Batting Around Ideas For How To Reinstate The Contentious Tax Rule

Lawmakers Launch Bipartisan Salt Caucus Escalating Push To Remove Cap On Federal Deductions For U S State And Local Taxes Marketwatch

Bill To Remove Cap On Salt Deduction Passes In House Zeldin Votes No 27 East

Analysis For Mass High Earners Tax Law S Cuts Will More Than Make Up For New Salt Cap Wbur News

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox

Squad Votes For Salt Deduction That Bernie Sanders Branded A Tax Break For The Rich

Salt Tax Repealed By House Democrats The Washington Post

House Democrats Concede Line In Sand Over Ending Salt Cap Politico